Reviews

BECOME A FULL-TIME PROFESSIONAL TRADER.

Learn to Live & Breathe Market Cycles, and Trade for a Living.

Designed with beginners in mind, Pro Trader provides the precise information to get you on your way to becoming a self-sustaining full-time trader.

ULTIMATE ACCESS 🚀

The Essential Toolbox For Learning To Trade The Financial Markets & Become a Professional Trader

✔ Full Curriculum Available Immediately

$99 / month

LIMITED TIME OFFER

ONLY: $79 USD / month

*Educational content only. Not personal or general financial advice. We do not know your objectives, financial situation or needs. Trading leveraged products involves risk. Historical results shown are not a reliable indicator of future performance.*

Here's What You're Getting

✔ Pro Trader Curriculum Access

✔ 2 x Beginner Trading Strategies

✔ Trade Ideas & Private Slack Space

✔ Weekly Roundtable (Live)

✔ Weekly Market Review (Recorded)

PLUS: These Extra Bonuses

✔ Monthly Community Call

✔ Pro Trader Recording Archives

✔ 24/7 Live Meeting Room

✔ Special Event Invitations

$99 / month

LIMITED TIME OFFER

ONLY: $79 USD / month

$1 for first month then billed monthly at $79/USD.

Cancel at any time.

"Thanks to Luke's teaching, and dedication to this community, even a mum with a full-time job like me can enjoy the process of learning."

- Jane A 🇬🇧

"I started Pro Trader knowing absolutely nothing about trading, and now - just 5 months later - I'm using advanced day trading strategies and sitting my first prop firm challenge."

- Alexandra K 🇳🇿

"Truly amazing, professional and clean curriculum with a lot of 'as-you-go' coaching, live sessions, market analysis etc. Luke is one of the best teachers I've seen, ever."

- Tony J 🇬🇧

"Becoming a consistently profitable trader isn't easy, and it can take a really long time to get there. But learning from the right people combined with Pro Trader's over-the-shoulder style video curriculum, it's achievable in months, rather than years."

- Luke Lawson -

Founder & 12+ Year Trader

TRADE SMARTER WITH PRO TRADER

Our carefully constructed trading method has been refined over the past 10+ years with step-by-step breakdowns of past trades so you can study how professionals thought through real market moves.

1

🧭 UNDERSTANDING MARKET MOVEMENTS

With this foundation, you’ll be crystal clear on how to decode charts & predict price action using the 6 timeless technical analysis core principles.

✅ Learn the 6 Core Principles that professionals have historically used to analyze price action.

Every profitable trader must first learn these principles.

✅ Learn how to properly risk manage and position size.

✅ Learn 2 beginner trading strategies, how to backtest them & build confidence in their profitability.

✅ Open a demo trading account and begin testing strategy performance.

✅ Practice the rules on a simulated account first; whether to trade live is your personal choice.

2

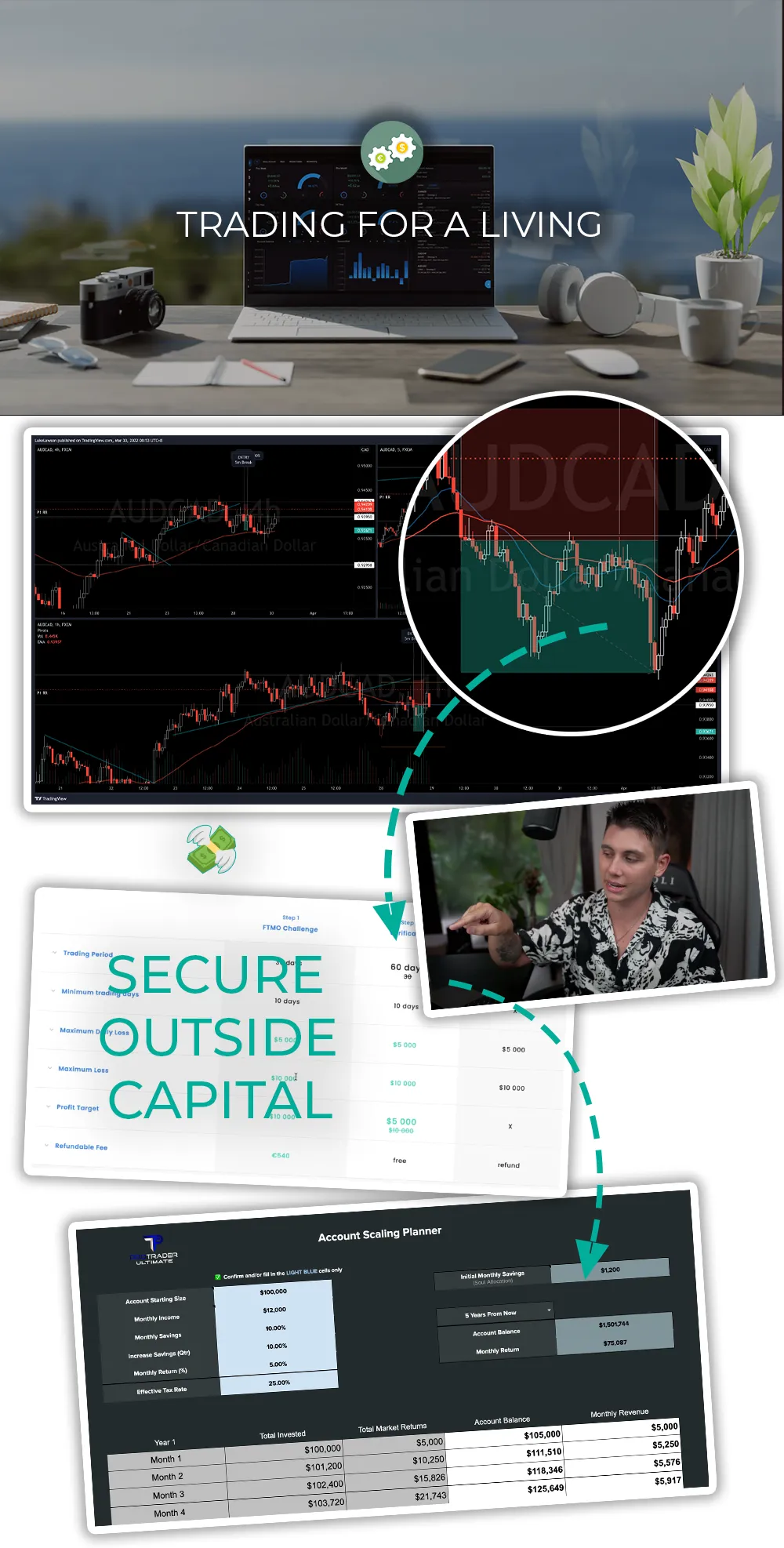

🏝 TRADING FOR A LIVING

Learn what it takes to become a full-time trader with a step by step guide to achieving whatever financial & life goals you set out to achieve.

✅ Achieve Stage 1 Financial Independence

**No need to rely on a boss or job to sustain your current standard of living.

✅ Introducing Multi-Timeframe Analysis and Day Trading!

✅ Master 2 x Day Trading strategies designed to capture intraday market moves.

✅ Leverage your skillset to secure outside capital from trading funds.

✅ Learn position-sizing frameworks that successful traders have used to scale their capital over years.

3

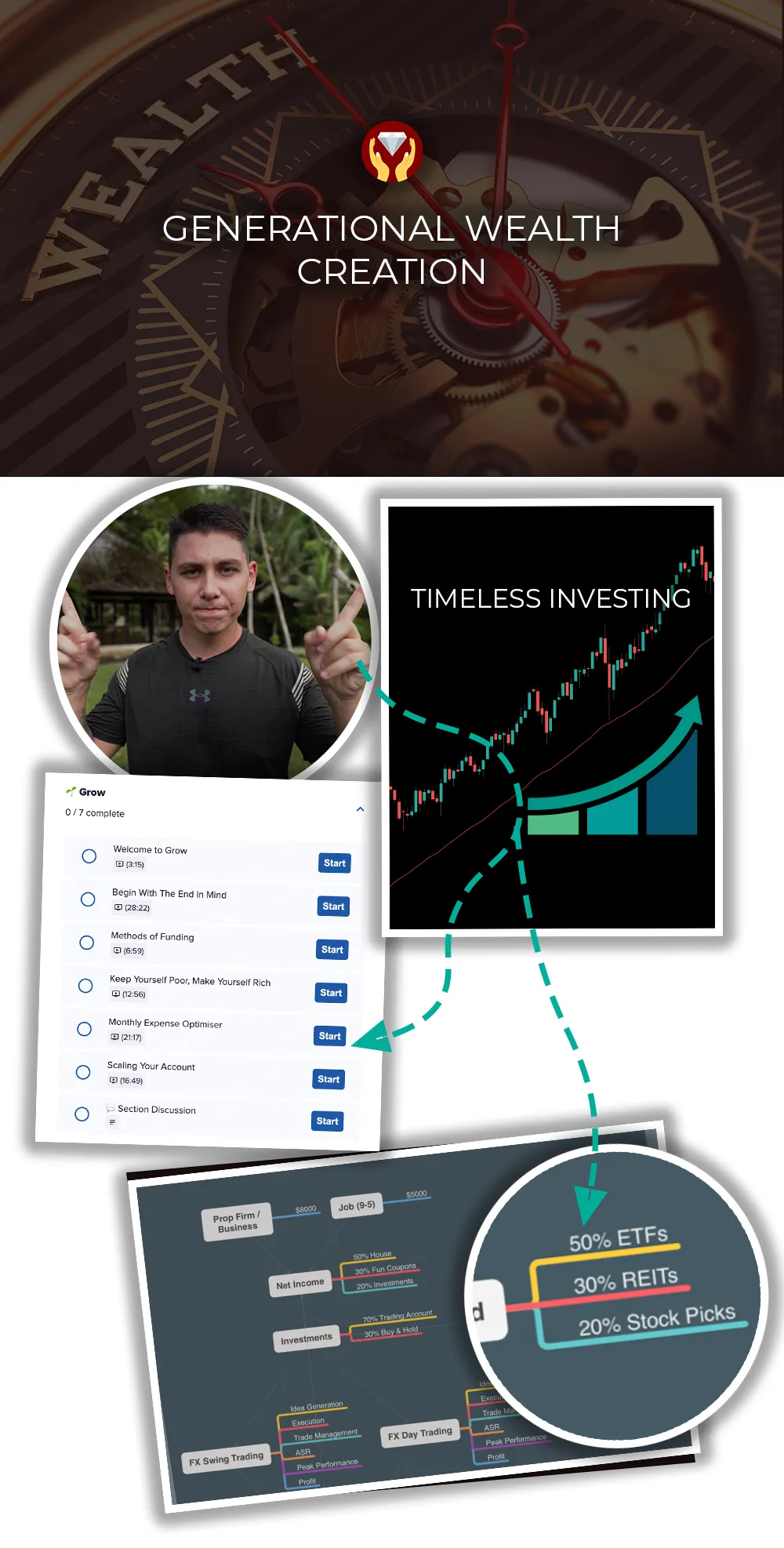

💎 GENERATIONAL WEALTH CREATION

Build a wealth empire using timeless investment strategies that will allow you to achieve Stage 2 Financial Independence that transcends your lifetime for your future generations.

✅ Harness the power of 4 x Institutional Grade trading strategies (advanced)

✅ Build a diversified wealth portfolio that will earn you consistent income independent of whether you show up to the charts or not, awake or asleep, alive or dead.

✅ Build a diversified wealth portfolio that will offer REAL security as you approach retirement (rather than a government pension!)

✅ Achieve Stage 2 Financial Independence* *Consistent income independent of if you show up to the charts or not, awake or asleep, transcends life & death.

💎 PLUS GET THESE ADDITIONAL BONUSES!

👥 MEMBERS GROUP

✔ Included in your membership

When you join, you'll be invited into our private Slack channel of movers & shakers from all over the world. This incredible group will motivate you, push you, & support you through your life-changing trading journey.

👨💻 WEEKLY & MONTHLY LIVE CALLS

✔ Included in your membership

✅ Weekly Market Forecast

✅ Weekly Roundtable (Live 60 min)

✅ Monthly Community Call (90 min)

✅ Direct Trade Support with Luke & more!

👨💻 WEEKLY & MONTHLY LIVE CALLS

✔ Included in your membership

✅ Weekly Market Review (Recorded)

✅ Weekly Roundtable (Live 60 min)

✅ Weekly Community Call (90 min)

✅ Direct Support with Luke & more!

🎥 PRO TRADER ARCHIVES

✔ Included in your membership

Unlock all previous weekly & monthly live calls & market forecast recordings. Over 60+ hours of value-packed educational videos that will take your trading to the next level!

🔑 GET ULTIMATE ACCESS

"Whether you're an experienced trader who wants to improve your trading results, or are completely new to trading and want to get started the right way with a solid foundation. Pro Trader is what you're looking for."

The Essential Toolbox For Learning To Trade The Financial Markets & Become a Professional Trader

✔ Full Curriculum Available Immediately

$1 for first month then billed monthly at $79/USD.

Cancel at any time.

*Educational content only. Not personal or general financial advice.

We do not know your objectives, financial situation or needs.*

Here's What You're Getting

✔ Pro Trader Curriculum Access

✔ 2 x Beginner Trading Strategies

✔ Trade Ideas & Private Slack Space

✔ Weekly Roundtable (Live)

✔ Weekly Market Review (Recorded)

PLUS: These Extra Bonuses

✔ Weekly Community Call

✔ Pro Trader Recording Archives

✔ 24/7 Live Meeting Room

✔ Special Event Invitations

$99 / month

LIMITED TIME OFFER

ONLY: $79 USD / month

$1 for first month then billed monthly at $79/USD.

Cancel at any time.

*Educational content only. Not personal or general financial advice. We do not know your objectives, financial situation or needs.*

🕊️ MONEY BACK GUARANTEE!

The Essential Toolbox For Learning To Trade The Financial Markets & Become a Professional Trader

TRY NOW WITH 30-DAY REFUND

If you don't feel like Pro Trader is the right fit for you within 30 days you can cancel and request a full refund. No questions asked!

$1 for first month then billed monthly at $79/USD.

Cancel at any time.

*Educational content only. Not personal or general financial advice. We do not know your objectives, financial situation or needs. Trading leveraged products involves risk. Historical results shown are not a reliable indicator of future performance.*

Copyright © Pro Trader X, All rights reserved